The stock market seems to be set for a could vertical rally as inflation continues to ease

The market rebounded quickly in 1982, with the S&P 500 recovering from a 27-month bear market in just four months. If inflation continues to slow faster than the Federal Reserve expects, stocks could see a similar rally, according to Fundstrat’s head of research Tom Lee.

Inflation expectations are a key factor driving real rates lower and equity valuations higher, Lee said in a note to clients Friday.

Inflation has been steadily declining, and is now at its lowest point in years. If this trend continues, it could have a positive effect on the stock market, according to Tom Lee of Fundstrat.

In 1982, a similar situation occurred, and the stock market rebounded quickly, reaching new highs. If inflation continues to decline, we could see a repeat of this scenario.

If inflation continues to surprise to the downside, we think equities could experience a vertical move higher, as investors re-rate equities on lower real rates.

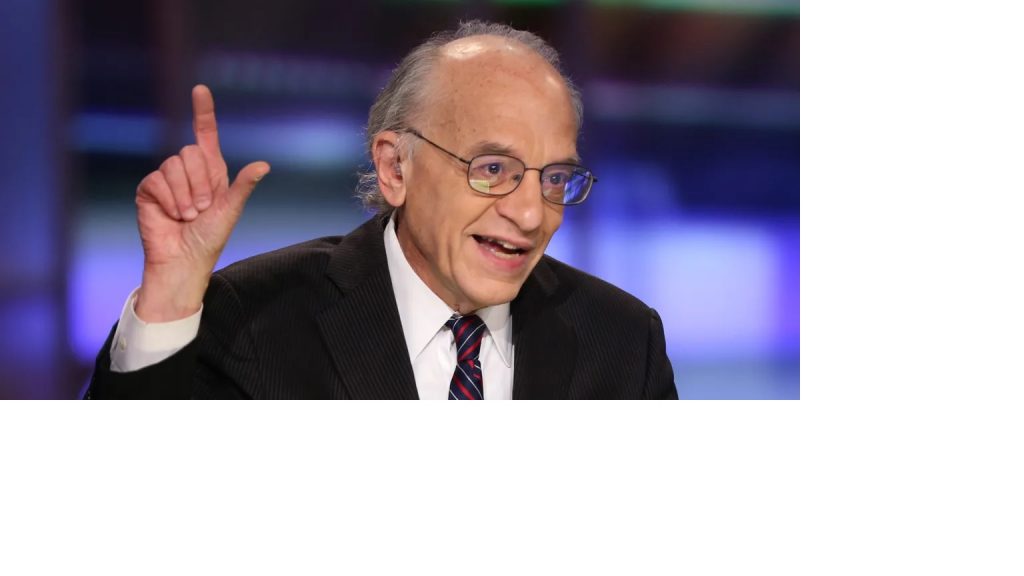

Jeremy Siegel, Professor of Finance at the Wharton School of the University of Pennsylvania in Philadelphia, believes that the lagging housing market data is creating a false reality of inflation.

He cites the example of how home prices affect the Consumer Price Index (CPI). When home prices are rising, homeowners feel wealthier and spend more. This increased spending then drives up prices for other goods and services, which is reflected in the CPI.

He expects housing starts to pick up and for inflation to return to its long-run target of 2%. Siegel sees this as a reason to be bullish on stocks, as they are currently undervalued.